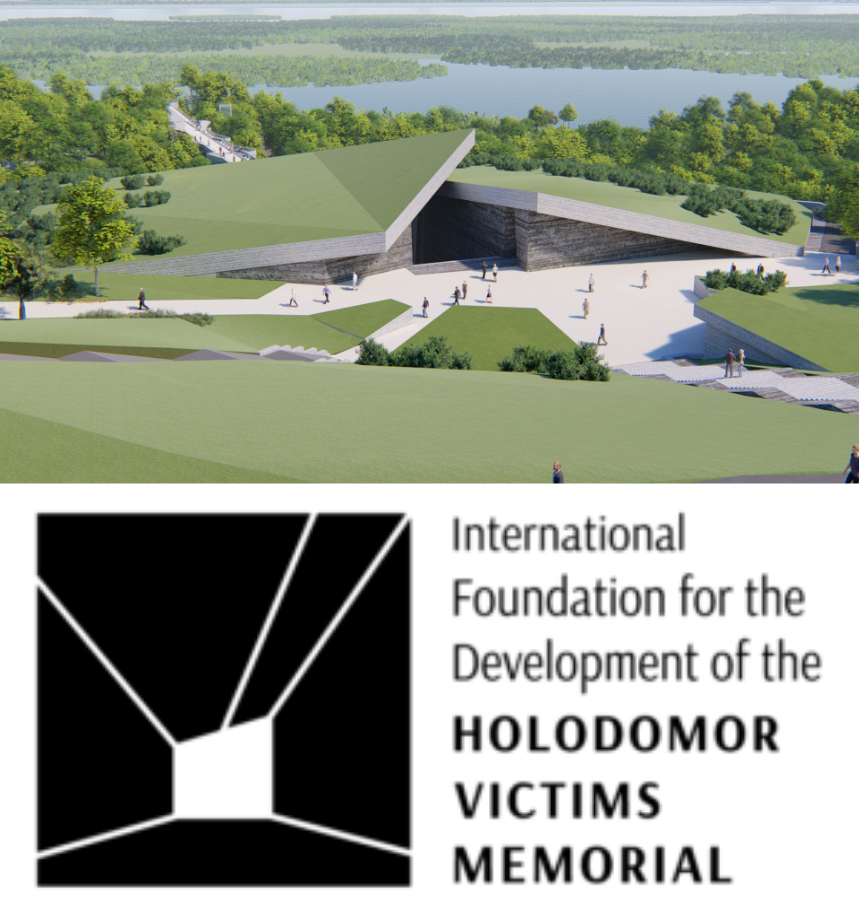

Featured Galleries CLICK HERE to View the Video Presentation of the Opening of the "Holodomor Through the Eyes of Ukrainian Artists" Exhibition in Wash, D.C. Nov-Dec 2021

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

Ten USUBC Historic Full Page Ads in the Kyiv Post

Ten USUBC Historic Full Page Ads in the Kyiv Post

Funding squeeze to continue for European financial services in 2012 EU public finances could face €116b hole as a result of the Financial Transactions Tax

Ernst & Young LLC, Kyiv, Ukraine

Ernst & Young LLC, Kyiv, Ukraine

17 January, 2012

LONDON, 17 JANUARY 2012: The Ernst & Young Eurozone financial services forecast predicts that solvency will remain an acute concern throughout the region in 2012, despite the recent positive action taken by the European Central Bank. The forecast for lending in the Eurozone has been significantly downgraded, institutions will be forced to fight over retail deposits and the resulting repatriation of capital is likely to hit Eastern Europe hard in particular, potentially pushing some economies in the region into recession.

Financial Transactions Tax (FTT) – the true impact on public finances

The report also analyzed the European Commission’s economic impact study for the Financial Transactions Tax and concluded that the original estimate of raising annual revenue of €37b is based on overly optimistic assumptions.

Marie Diron economic advisor to Ernst & Young Eurozone financial services forecast said: “The Commission has acknowledged that it did not address the impact of lower GDP on revenue collection from other taxes. Even when modeled against the best case scenario this incurs a €39b loss, making the net impact on overall tax revenues a loss of €2b. Importantly, these figures do not take into account the likely fall in capital gains tax nor the full extent of the decline in revenues from the financial sector itself, which will significantly increase the loss in total revenue.”

Using less optimistic assumptions about the impact of the FTT on trading volumes, taking into account lower revenues from other taxes, and modeled against a GDP loss of 1.76%,[1] the net loss to public finances would stand at €116b.

Marie added: “The Commission’s figures in the impact study for the FTT are not misleading - they do clearly outline where they have made assumptions and what they have left out of the calculations, but the publicized €37b revenue figure definitely masks the true effect of the tax on EU public finances.”

Despite ECB action, funding remains tight and costly

Despite the recent issue of three year loans by the European Central Bank (ECB), the forecast and analysis indicate that banks across the Eurozone and beyond will continue to face ongoing funding pressure.

Andy Baldwin, head of financial services Europe, Middle East, India and Africa at Ernst & Young, comments: “New funding only makes up about a third of the total of the take up of the ECB loans. All of the new funding issued by the ECB needs to be backed by collateral, meaning that unsecured wholesale markets are likely to remain closed for the foreseeable future. The irony is that, given the high level of deposits currently being held at the ECB, these extra funds have added little extra liquidity to the market.

“An interesting area to watch in the months ahead will be how much of the new funding finds its way into sovereign bonds - and which countries benefit. It is clear that politicians are hopeful the new funding will help drive down funding costs. However, we expect regulatory pressure on capital and liquidity for banks and insurers to continue unabated. Shareholder pressure to scale back investment in selected wholesale and trading areas, coupled with increased regulation of derivatives trading and clearing houses, will increase funding costs across the sector.”

Forecast for lending sharply downgraded, damaging long-term growth potential

The forecast predicts GDP growth in the Eurozone to slow sharply to just 0.2% in 2012, down from 1.6% in 2011. This slow growth combined with the increased cost of credit means that total loans in the Eurozone are forecast to contract by 0.9% in 2012, a significant downward revision to the last forecast’s previous expectation for positive growth of 1.2%.

“This still represents a less severe contraction than the aftermath of the financial crisis in 2009, when total bank loans fell by around 2.5%,” said Marie, “but lending to businesses is forecast to contract by 0.8%, a downward revision from 2.0%, which will be felt most strongly by the already squeezed SMEs, potentially limiting the future growth potential for Eurozone economies.”

Crisis threatens to spill over to Eastern Europe

As the deleveraging cycle intensifies, the outlook predicts increased market fragmentation and a reduction in cross-border flow of capital.

Andy comments: “The capital squeeze on the Eurozone banks will see a continuation of the current trend to repatriate some of their capital. This is a worrying development for many Eastern European economies as nearly three quarters of lending in Eastern Europe depends on Eurozone parent entities. These parent entities should carefully consider their long-term strategies in emerging markets, as competition from Asia Pacific and domestic institutions could well exclude them from these markets permanently.”

Marie adds “Eurozone bank claims total around 34% of Eastern European GDP, the resulting shrinkage of credit could well push several Eastern European economies into recession. The Czech Republic stands out as having the greatest reliance on lending from Eurozone banks, but local subsidiaries are not heavily dependent on funding lines so deleveraging should remain contained. Credit shrinkage is likely to be much more severe in Hungary, where non-performing loans are already rising rapidly, and deleveraging in Romania and Bulgaria is likely to be significant due to the presence of Greek subsidiaries.”

Retail banks’ deposit war will hit insurers and asset managers

The liquidity gap will force institutions to compete for retail deposits and investments, which risks eroding profit margins across the board.

Andy concludes: “In many countries funding pressures will force banks to compete fiercely with each other to attract retail deposits, and we predict that savings products will start to be seen as an alternative to the investment products already on the market. Insurers are already struggling to meet guaranteed returns in the low interest rate environment, but will find themselves unable to control their costs by lowering the returns offered on investment products. They may have to deploy further capital reserves to remain competitive.

“The outlook for asset management is not much better. The mass retail investment market continues to face net outflows and negative investment returns. There is a risk that this period of prolonged low returns may feedback to lower net inflows beyond 2012, with households channeling their limited savings into the higher interest bank deposits or debt repayment rather than fund-based investment.”

About Ernst & Young

Ernst & Young is a global leader in assurance, tax, transaction and advisory services. Worldwide, our 152,000 people are united by our shared values and an unwavering commitment to quality. We make a difference by helping our people, our clients and our wider communities achieve their potential.

Ernst & Young expands its services and resources in accordance with clients’ needs throughout the CIS. 4000 professionals work at 18 offices in Moscow, St. Petersburg, Novosibirsk, Ekaterinburg, Kazan, Krasnodar, Togliatti, Yuzhno-Sakhalinsk, Almaty, Astana, Atyrau, Baku, Kyiv, Donetsk, Tashkent, Tbilisi, Yerevan, and Minsk.

Ernst & Young established its practice in Ukraine in 1991. Ernst & Young Ukraine now employs more than 500 professionals providing a full range of services to a number of multinational corporations and Ukrainian enterprises.

For more information, please visit www.ey.com/ua.

Ernst & Young refers to the global organization of member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

This news release has been issued by EYGM Limited, a member of the global Ernst & Young organization that also does not provide any services to clients.

[1] The loss acknowledged by the Commission as possible if mitigating factors prove less effective than hoped.