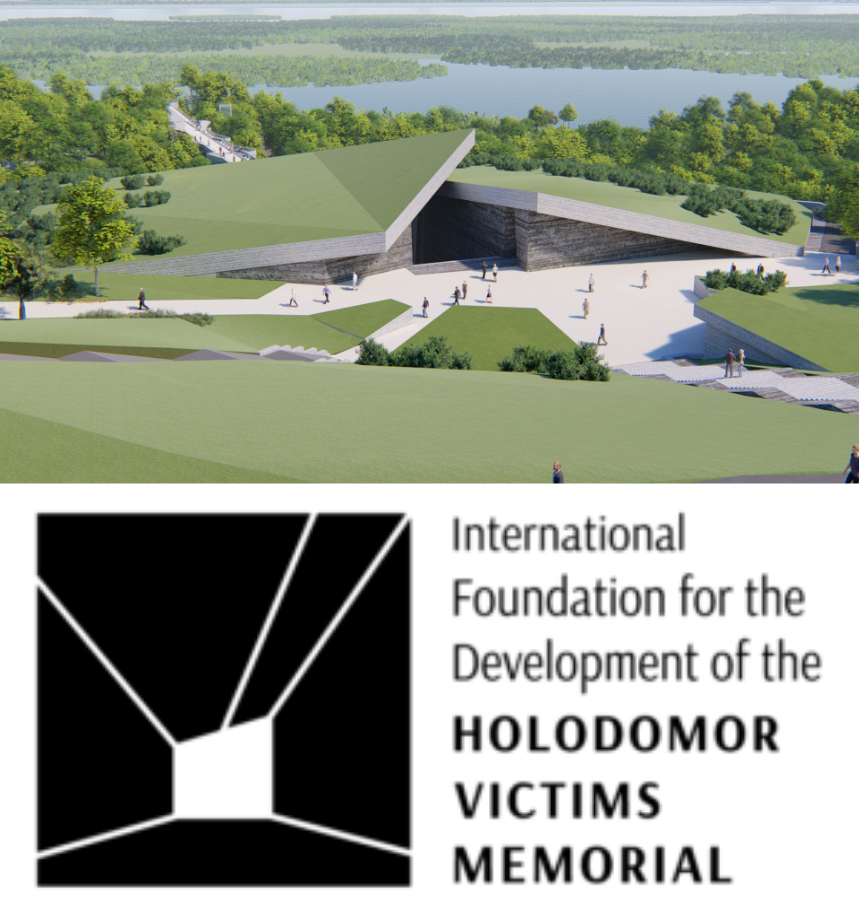

Featured Galleries CLICK HERE to View the Video Presentation of the Opening of the "Holodomor Through the Eyes of Ukrainian Artists" Exhibition in Wash, D.C. Nov-Dec 2021

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

Ten USUBC Historic Full Page Ads in the Kyiv Post

Ten USUBC Historic Full Page Ads in the Kyiv Post

Salans advises Europe Virgin Fund on its acquisition of a controlling stake in Ukraine’s leading hygiene products manufacturer (TM "Ruta")

Salans LLC, Kyiv, Ukraine

Salans LLC, Kyiv, Ukraine

8 July, 2011

Salans advised Europe Virgin Fund L.P. (‘EVF’), a private equity fund sponsored by Dragon Capital, on its acquisition of a majority stake in Tissico Limited, a Cyprus-based holding company for VGP, Ukraine’s leading manufacturer of hygiene products. This investment has been made by means of a share capital increase in Tissico Limited, providing the group with fresh capital to be used for expanding VGP’s production capacities and strengthening the company’s market position on both domestic and export markets. Illia Miretskyi, the previous majority owner of VGP, has retained a significant minority shareholding in the group and shall continue managing VGP as Chief Executive Officer.

Salans’ team in Ukraine was led by Oleg Batyuk (Partner, Salans Kyiv), with key input from Christopher Winn (Associate, London), Boris Schwarzer (Associate, Kyiv), Yaroslav Malomuzh (Associate, Kyiv), Anzhelika Shtukaturova (Associate, Kyiv), Tatiana Tugolukova (Associate, Kyiv), and assisted the client in legal due diligence of the target company, transaction structuring and preparation of all relevant documentation, as well as obtaining an approval from the Antimonopoly Committee of Ukraine.

“We are happy to announce the investment in Ruta as EVF’s first transaction as it perfectly meets our investment strategy. The company’s management team led by Illia Miretskyi has done a tremendous job in establishing Ruta as a leading brand in the market. I am sure the team and the company will do even better with our capital and support," said Kamil Goca, Managing Director, Private Equity, Dragon Capital.

Oleg Batyuk, Managing Partner of Salans Kyiv office, commented: “We were very pleased to act for Dragon Capital on formation of the Europe Virgin Fund L.P. in 2010 and now on the fund’s first investment in Ukraine.”

About Salans

Salans (www.salans.com) is a full service leading international law firm with 22 offices worldwide. Salans LLP has offices, or is associated with Salans offices in: Almaty, Baku, Barcelona, Beijing, Berlin, Bratislava, Brussels, Bucharest, Budapest, Frankfurt, Hong Kong, Istanbul, Kyiv, London, Madrid, Moscow, New York, Paris, Prague, Shanghai, St. Petersburg, Warsaw. In 2010 Salans was named “Law Firm of the Year in Europe” by The Lawyer.

About VGP

VGP (www.ruta.ua) (Lutsk, Western Ukraine) is Ukraine’s leading manufacturer of hygiene products such as toilet paper, paper towels, napkins and hankies. The company’s product portfolio is made exclusively from natural, environmentally-clean virgin pulp, on high-tech equipment and in accordance with generally accepted international standards. Having started the tissue paper products operations in 1999, VGP today accounts for about 20% of the Ukrainian tissue paper products market and successfully exports to Russia, Belarus, Moldova, Hungary, Kazakhstan, Latvia, Lithuania, Estonia and Kyrgyzstan.

About Europe Virgin Fund

Europe Virgin Fund is a regional private equity fund sponsored by Dragon Capital with a target size of $150 million. The Fund will provide equity financing to up to a dozen private sector businesses with primary operations in Ukraine, Belarus and Moldova, in particular, in fast-moving consumer goods, retail, industrial, telecom, media, technology, pharmaceuticals, construction materials and financial services sectors. Europe Virgin Fund raised $45 million at its first closing in August 2010, having received commitments from Dragon Capital, the European Bank for Reconstruction and Development, the Swiss Investment Fund for Emerging Markets and other limited partners.

About Dragon Capital

Dragon Capital (www.dragon-capital.ua) is Ukraine’s leading investment bank offering a comprehensive range of services in equities and fixed income sales, trading and research, investment banking, private equity and asset management to institutional, corporate and private clients. Established in 2000, the company is an independent partnership controlled by management, with a minority stake held by Goldman Sachs. Dragon Capital accounts for the largest share of turnover on the Ukrainian stock market carrying out approximately a third of reported transactions. The company has completed more than 90 deals, including IPOs, private placements, M&A transactions and debt financings, since 2005, raising over $3.0 billion. Dragon’s asset management arm has approximately $0.6 billion under management.