Featured Galleries CLICK HERE to View the Video Presentation of the Opening of the "Holodomor Through the Eyes of Ukrainian Artists" Exhibition in Wash, D.C. Nov-Dec 2021

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

Ten USUBC Historic Full Page Ads in the Kyiv Post

Ten USUBC Historic Full Page Ads in the Kyiv Post

UKRAINE: TBF INVESTOR SENTIMENT SURVEY

The Bleyzer Foundation (TBF)

Kyiv, Ukraine, Friday, February 4, 2011

KYIV - At the end of 2010, The Bleyzer Foundation (TBF), Kyiv, Ukraine, conducted its second survey of investor sentiment in Ukraine. Our respondents are members of the U.S.-Ukraine Business Council (USUBC), who also participated in our survey in the first quarter of 2010. Because of the small size of this sample, the result of the survey should not be interpreted to represent the entire inventor community in Ukraine.

However, since most of the responses were received from foreign investors, this survey provides a valuable snapshot of investor attitudes and expectations, and allows us to track changes in investor confidence over the course of 2010.

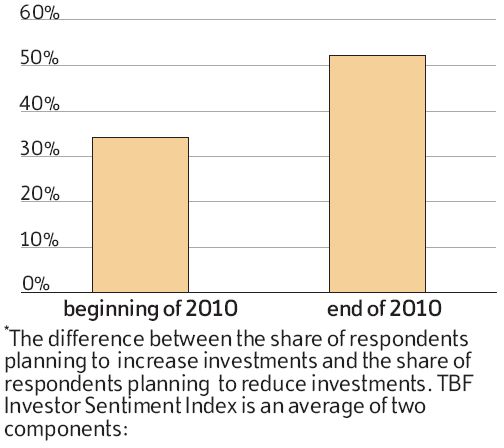

The results are encouraging. Overall, the willingness of companies to invest both in Ukraine and in other countries has significantly improved thanks to more stable national and global economic and financial conditions. Indeed, a higher share of respondents plans to invest more in the future compared to the beginning of 2010 (see chart 1).

Chart 1. TBF Investor Sentiment Index

inventors planning to invest more within the next 6 months, %*

*The difference between the share of respondents planning to increase investments and the share of respondents planning to reduce investments. TBF Investor Sentiment Index is an average of two components:

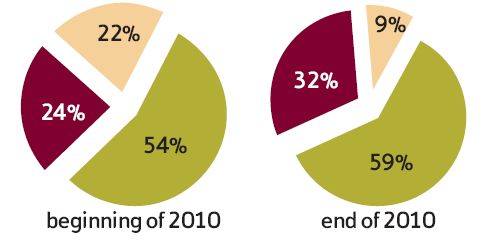

Component 1. Six months from now your investments in Ukraine will be:

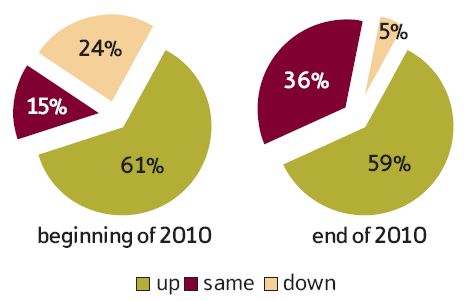

Component 2. Six months from now your investments in other countries will be:

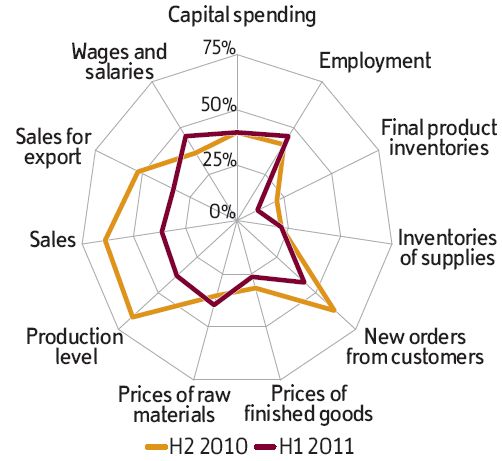

Our survey sheds some light on the sources of stronger business performance in 2010 compared to the economic downturn of 2009. In particular, we asked investors to comment on a set of business indicators relating to their companies, including production, sales, prices, costs, employment and wages. Companies also reported their expectations on the dynamics of these indicators in the first half of 2011 (see chart 2).

Chart 2. Company related business indicators

difference between the share of investors reporting improvement and the share of respondents reporting worsening of the indicator, %

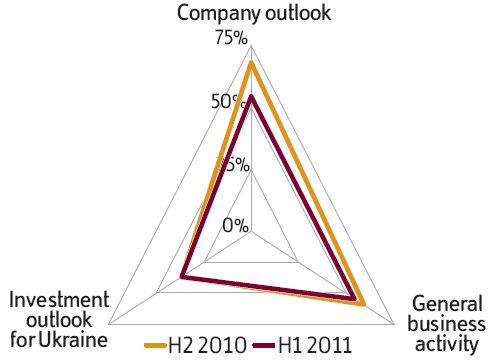

Overall, the second half of 2010 saw higher output growth thanks to stronger sales, including sales for exports. Somewhat slower growth of sales and output is expected in the first half of this year due to slower expansion of orders from new and existing customers. That said, capital spending and employment will continue to grow at about the same pace, which may imply that investors feel more confident about expanding production capacity. After all, the majority of respondents still believe that general business conditions and the investment outlook for Ukraine are getting better (see chart 3).

Chart 3. Business conditions and investment outlook

difference between the share of investors reporting improvement and the share of respondents reporting worsening of the indicator, %

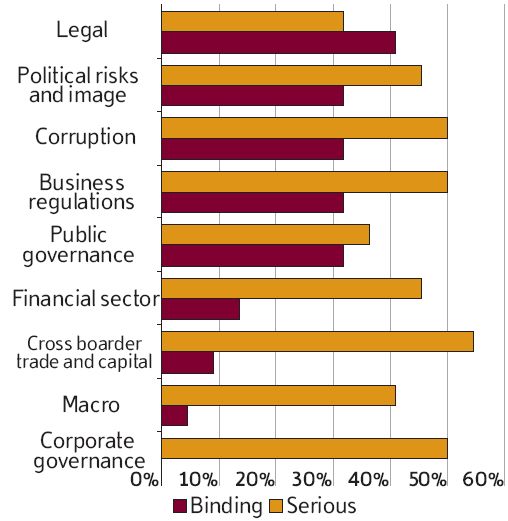

At the same time, many investors still find the business and investment environment in Ukraine quite challenging (see chart 4).

Chart 4. Business environment remains challenging

respondents indicating that the factor is a binding and serious constraint on investment activity in Ukraine, % of all

Finally, our survey points to a shift in investors’ concerns. In particular, if at the beginning of 2010, macroeconomic stability and legal environment were top concerns for investors, at the end of 2010 corruption and business regulation emerged as major obstacles for the investment climate in Ukraine.

Chart 5. Major obstacles to the expansion of business and investment in Ukraine*

*The end of 2010 survey shows a combined percentage of respondents indicating that the factor is a binding and serious constraint.

The beginning of 2010 survey shows a combined percentage of respondents indicating that the factor severity ranged from 1 to 5.