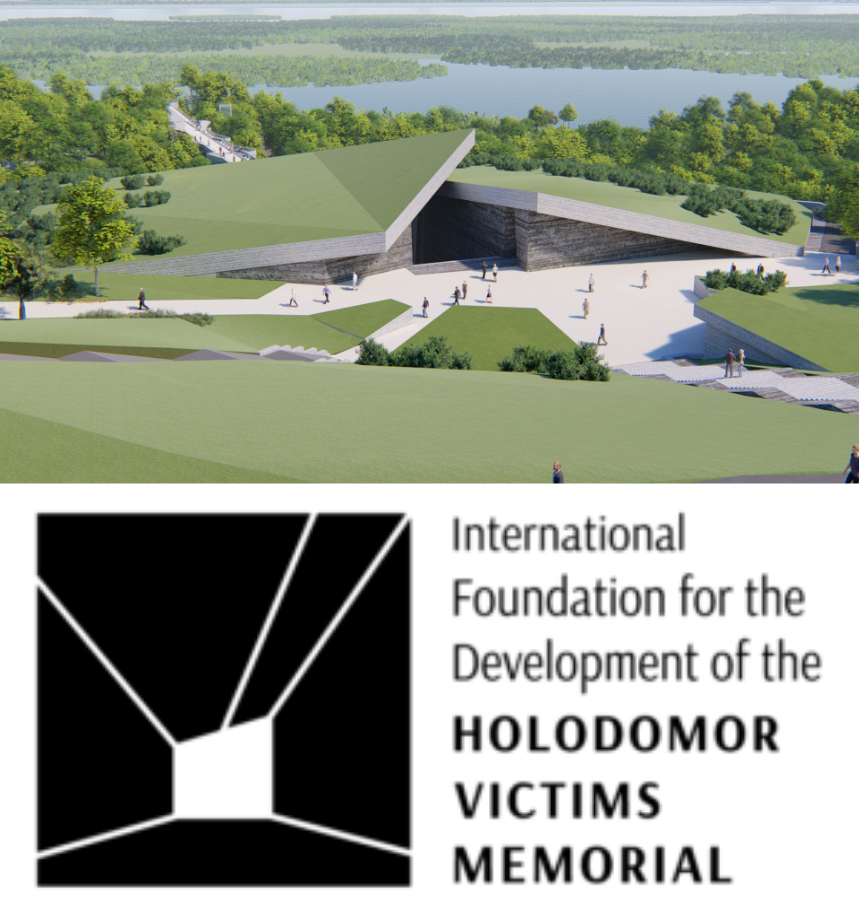

Featured Galleries CLICK HERE to View the Video Presentation of the Opening of the "Holodomor Through the Eyes of Ukrainian Artists" Exhibition in Wash, D.C. Nov-Dec 2021

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

Ten USUBC Historic Full Page Ads in the Kyiv Post

Ten USUBC Historic Full Page Ads in the Kyiv Post

EPAM Systems Reports Record Results for Fourth Quarter and Full Year 2012

EPAM Systems, Newtown, PA

Washington, D.C., Wednesday, February 27, 2013

-

Fourth Quarter revenues up 14% sequentially and 32% year-over-year

-

Annual revenues of $433.8 million, up 30% year-over-year

-

Double digit growth in profitability achieved in both fourth quarter and full year 2012

-

2013 revenues expected to increase by 23% to 25%

Newtown, PA - February 27, 2013 - EPAM Systems, Inc. (NYSE: EPAM), a leading provider of complex software engineering solutions and a leader in Central and Eastern European IT services delivery, today announced record results for its fourth quarter and full year ended December 31, 2012.

Arkadiy Dobkin, CEO and President commented, "Our strong fourth quarter and full year 2012 results demonstrate the competitiveness of our business proposition. By combining our core strengths in software engineering with our strong expertise in a number of emerging technologies and our fast developing domain knowledge, EPAM is differentiated as a provider of high quality, complex technology and business solutions to meet the rapidly-changing needs of global clients. Consequently, we reported significant year-over-year revenue growth across our three geographic regions and most of our key vertical markets in both the fourth quarter and full year 2012.

Profitability was in line with our guidance, as we continued to post double-digit year-on-year improvement in both the fourth quarter and full year 2012, while investing in people and infrastructure that will drive future growth. At the end of the fourth quarter, we completed an important strategic transaction with the acquisition of Empathy Lab, a digital strategy and multi-channel experience design firm that significantly strengthens our position as a global provider of end-to-end digital services and multi-channel eCommerce solutions. The integration of Empathy Lab is currently underway, and we are working together on business development initiatives to drive revenue synergies."

Fourth Quarter 2012 Highlights

-

Revenues increased to a record $125.5 million, up 32.0% year-on-year and 14.0% sequentially

-

GAAP income from operations was $18.7 million, an increase of 20.9% compared to $15.4 million in the fourth quarter of 2011

-

Non-GAAP income from operations was $20.6 million, an increase of $4.2 million or 26.0%, from $16.3 million in the fourth quarter of 2011

-

Quarterly diluted earnings per share (EPS) on a GAAP basis was $0.32, up from $0.29 in the year-ago quarter

-

Non-GAAP quarterly diluted EPS was $0.37, up 23% from $0.30 in the year-ago quarter

EPAM generated cash from operations of $35.8 million in the fourth quarter of 2012, an increase of $9.4 million generated over the fourth quarter of 2011.

Reconciliations of non-GAAP financial measures to operating results and diluted EPS are included at the end of this release.

Full Year 2012 Highlights

-

Revenues increased 29.7% to a record $433.8 million, up from $334.5 million reported in 2011

-

GAAP income from operations for 2012 was $66.0 million, an increase of 20.0% over 2011

-

Non-GAAP income from operations was $74.9 million compared to $60.9 million in 2011

-

Diluted EPS on a GAAP basis was $1.17, compared to $0.63 in the previous year

-

Non-GAAP diluted EPS was $1.42, compared to $1.19 in 2011

-

Net headcount for IT professionals increased 21.9% to 8,495 as of December 31, 2012, from 6,968 as of December 31, 2011

For full year 2012, EPAM generated operating cash flow of $48.5 million. As of December 31, 2012 EPAM had cash and cash equivalents of $118.1 million.

Full Year and First Quarter 2013 Outlook

"Based on our visibility and the market conditions we see for our service offerings, we are confident that our growth momentum will continue in 2013 and beyond. To support this expansion, we will continue to invest in the development of technical competencies that are critical to our success and to build our on-site presence to better support complex solution delivery requirements. Additionally, we will evaluate organic opportunities as well as acquisitions to expand our scope of services, complement existing technical expertise, and add new vertical markets," concluded Mr. Dobkin.

Based on current conditions, EPAM expects year-over-year revenue growth in the range of 23% to 25%. Non-GAAP net income growth for 2013 is expected to be in the range of 12% to 15% year-over-year, with an increase in the effective tax rate to approximately 20%.

For the first quarter of 2013, EPAM expects revenue between $122 million and $125 million, representing a growth rate of 29% to 31% over first quarter 2012 revenue, which includes results from two acquisitions made in 2012 that were not in the comparable period. First quarter 2013 non-GAAP diluted EPS is expected to be in the range of $0.32 to $0.34 based on an estimated first quarter 2013 weighted average of 47.6 million diluted shares.

Conference Call Information

EPAM will hold a conference call to discuss its fourth quarter and full year 2012 results at 8:00 a.m. Eastern time, on Thursday, February 28, 2013. A live webcast of the call may be accessed over the Internet from EPAM's Investor Relations website at investors.epam.com. Participants should follow the instructions provided on the website to download and install the necessary audio applications. The conference call also is available by dialing 1-877-407-0784 (domestic) or 1-201-689-8560 (international) and entering passcode 409154. Participants should ask for the EPAM Systems fourth quarter and full year 2012 conference call.

A replay of the live conference call will be available approximately one hour after the call. The replay will be available on EPAM's website or by dialing 1-877-870-5176 (domestic) or 1-858-384-5517 (international) and entering the replay passcode 409154. The telephonic replay will be available until March 10, 2013.

About EPAM Systems

Established in 1993, EPAM Systems, Inc. (NYSE:EPAM) provides software engineering solutions through its leading Central and Eastern European service delivery platform. Headquartered in the United States, EPAM employs approximately 8,500 IT professionals and serves clients worldwide from its locations in the United States, Canada, UK, Switzerland, Germany, Sweden, Belarus, Hungary, Russia, Ukraine, Kazakhstan and Poland.

Non-GAAP Financial Measures

EPAM supplements results reported in accordance with principles generally accepted in the United States, referred to as GAAP, with non-GAAP financial measures. Management believes these measures help illustrate underlying trends in EPAM's business and uses the measures to establish budgets and operational goals, communicated internally and externally, for managing EPAM's business and evaluating its performance. Management also believes these measures help investors compare EPAM's operating performance with its results in prior periods and compare EPAM and similar companies. EPAM anticipates that it will continue to report both GAAP and certain non-GAAP financial measures in its financial results, including non-GAAP results that exclude stock-based compensation expense, write-off and recovery, amortization of purchased intangible assets, goodwill impairment, legal settlement, foreign exchange gains and losses, and M&A costs. However, because EPAM's reported non-GAAP financial measures are not calculated according to GAAP, these measures are not comparable to GAAP and may not necessarily be comparable to similarly described non-GAAP measures reported by other companies within EPAM's industry. Consequently, EPAM's non-GAAP financial measures should not be evaluated in isolation or supplant comparable GAAP measures, but, rather, should be considered together with its consolidated financial statements, which are prepared according to GAAP.

Forward-Looking Statements

This press release includes statements which may constitute forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, the accuracy of which are necessarily subject to risks, uncertainties, and assumptions as to future events that may not prove to be accurate. Factors that could cause actual results to differ materially from those expressed or implied include general economic conditions and the factors discussed in our most recent Annual Report on Form 10-K and other filings with the Securities and Exchange Commission. EPAM undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required under applicable securities law.

Contact:

EPAM Systems, Inc.

Ilya Cantor, Chief Financial Officer

Phone: +1-267-759-9000 x64588

Fax: +1-267-759-8989

investor_relations@epam.com

EPAM SYSTEMS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME

Three Months Ended | Year Ended | ||||||||

December 31, | December 31, | ||||||||

2012 | 2011 | 2012 | 2011 | ||||||

(in thousands, except share and per share data) | |||||||||

Revenues | $125,538 | $95,127 | $433,799 | $334,528 | |||||

Operating expenses: | |||||||||

Cost of revenues (exclusive of depreciation and amortization) | 77,284 | 59,388 | 270,361 | 205,336 | |||||

Selling, general and administrative expenses | 26,377 | 18,510 | 85,868 | 64,930 | |||||

Depreciation and amortization expense | 3,208 | 1,806 | 10,882 | 7,538 | |||||

Goodwill impairment loss | - | - | - | 1,697 | |||||

Other operating expenses, net | 13 | (4) | 682 | 19 | |||||

Income from operations | 18,656 | 15,427 | 66,006 | 55,008 | |||||

Interest and other income, net | 519 | 422 | 1,941 | 1,422 | |||||

Foreign exchange loss | (135) | (500) | (2,084) | (3,638) | |||||

Income before provision for income taxes | 19,040 | 15,349 | 65,863 | 52,792 | |||||

Provision for income taxes | 4,041 | 2,965 | 11,379 | 8,439 | |||||

Net Income | $14,999 | $12,384 | $54,484 | $44,353 | |||||

Comprehensive income | $15,640 | $11,535 | $56,977 | $43,103 | |||||

Accretion of preferred stock | - | - | - | (17,563) | |||||

Net income allocated to participating securities | - | (6,941) | (3,341) | (15,025) | |||||

Net income available for common stockholders | 14,999 | 5,443 | 51,143 | 11,765 | |||||

| Net income per share of common stock: | |||||||||

Basic (common) | 0.35 | 0.32 | 1.27 | 0.69 | |||||

Basic (puttable common) | - | 0.32 | - | 1.42 | |||||

Diluted (common) | 0.32 | 0.29 | 1.17 | 0.63 | |||||

Diluted (puttable common) | - | 0.29 | - | 0.77 | |||||

Shares used in calculation of net income per share of common stock: | |||||||||

Basic (common) | 43,294 | 17,141 | 40,190 | 17,094 | |||||

Basic (puttable common) | - | 18 | - | 18 | |||||

Diluted (common) | 46,604 | 20,520 | 43,821 | 20,473 | |||||

Diluted (puttable common) | - | 18 | - | 18 | |||||

EPAM SYSTEMS INC. AND SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS

As of December 31, 2012 | As of December 31, 2011 | ||||

(in thousands, except share and per share data) | |||||

Assets Current assets | |||||

Cash and cash equivalents | $118,112 | $88,796 | |||

Accounts receivable, net of allowance of $2,203 and $2,250, respectively | 78,906 | 59,472 | |||

Unbilled revenues | 33,414 | 24,475 | |||

Prepaid and other current assets | 12,264 | 6,436 | |||

Time deposits | 1,006 | - | |||

Restricted cash, current | 660 | - | |||

Deferred tax assets, current | 6,593 | 4,384 | |||

Total current assets | 250,955 | 183,563 | |||

Property and equipment, net | 53,135 | 35,482 | |||

Restricted cash, long-term | 467 | 2,582 | |||

Intangible assets, net | 16,834 | 1,251 | |||

Goodwill | 22,698 | 8,169 | |||

Deferred tax assets, long-term | 6,093 | 1,875 | |||

Other long-term assets | 632 | 2,691 | |||

Total assets | $350,814 | $235,613 | |||

| Liabilities Current liabilities | |||||

Accounts payable | $6,095 | $2,714 | |||

Accrued expenses | 19,814 | 24,782 | |||

Deferred revenue | 6,369 | 6,949 | |||

Due to employees | 12,026 | 8,234 | |||

Taxes payable | 14,557 | 8,712 | |||

Deferred tax liabilities, current | 491 | 1,736 | |||

Total current liabilities | 59,352 | 53,127 | |||

Deferred revenue, long-term | 1,263 | - | |||

Taxes payable, long-term | 1,228 | 1,204 | |||

Deferred tax liabilities, long-term | 2,691 | 283 | |||

Total liabilities | 64,534 | 54,614 | |||

Commitments and contingencies | |||||

Preferred stock, $.001 par value; 0 and 5,000,000 authorized at December 31, 2012 and December 31, 2011; 0 and 2,054,935 Series A-1 convertible redeemable preferred stock issued and outstanding at December 31, 2012 and December 31, 2011; $.001 par value 0 and 945,114 authorized at December 31, 2012 and December 31, 2011, 0 and 384,804 Series A-2 convertible redeemable preferred stock issued and outstanding at December 31, 2012 and December 31, 2011 | - | 85,940 | |||

Stockholders' equity | |||||

Common stock, $.001 par value; 160,000,000 authorized; 45,398,523 and 18,914,616 shares issued, 44,442,494 and 17,158,904 shares outstanding at December 31, 2012 and December 31, 2011, respectively | 44 | 17 | |||

Preferred stock, $.001 par value; 0 and 290,277 authorized Series A-3 convertible preferred stock issued and outstanding at December 31, 2012 and December 31, 2011, respectively | - | - | |||

Additional paid-in capital | 166,962 | 40,020 | |||

Retained earnings | 128,992 | 74,508 | |||

Treasury stock | (8,697) | (15,972) | |||

Accumulated other comprehensive loss | (1,021) | (3,514) | |||

Total stockholders' equity | 286,280 | 95,059 | |||

Total liabilities and stockholders' equity | $350,814 | $235,613 | |||

EPAM SYSTEMS, INC. AND SUBSIDIARIES

Reconciliations of Non-GAAP Financial Measures to Comparable GAAP Measures

(Unaudited)

(In thousands, except per share amounts)

Three Months Ended | Year Ended | ||||||||||||

December 31, | December 31, | ||||||||||||

2012 | 2012 | 2012 | 2012 | 2012 | 2012 | ||||||||

GAAP | Adjustments | Non-GAAP | GAAP | Adjustments | Non-GAAP | ||||||||

Income from operations | $18,656 | $1,896 | $20,552 | (a) | $66,006 | $8,934 | $74,940 | (a) | |||||

Operating margin | 14.9% | 1.50% | 16.4% | 15.2% | 2.10% | 17.3% | |||||||

Net income | $14,999 | $2,031 | $17,030 | (b) | $54,484 | $11,018 | $65,502 | (b) | |||||

Diluted earnings per share | $0.32 | $0.37 | (c) | $1.17 | $1.42 | (c) | |||||||

Three Months Ended | Year Ended | ||||||||||||

December 31, | December 31, | ||||||||||||

2011 | 2011 | 2011 | 2011 | 2011 | 2011 | ||||||||

GAAP | Adjustments | Non-GAAP | GAAP | Adjustments | Non-GAAP | ||||||||

Income from operations | $15,427 | $887 | $16,314 | (a) | $55,008 | $5,869 | $60,877 | (a) | |||||

Operating margin | 16.2% | 0.9% | 17.1% | 16.4% | 1.8% | 18.2% | |||||||

Net income | $12,384 | $1,387 | $13,771 | (b) | $44,353 | $9,507 | $53,860 | (b) | |||||

Diluted earnings per share | $0.29 | $0.30 | (c) | $0.63 | $1.19 | (c) | |||||||

Notes: |

| ||||||||

Three Months Ended | Year Ended | ||||||||

December 31, | December 31, | ||||||||

2012 | 2011 | 2012 | 2011 | ||||||

(a) | |||||||||

Adjustment to GAAP Income from operations: | 1,896 | 887 | 8,934 | 5,869 | |||||

Stock-based compensation, of which: | 1,457 | 712 | 6,826 | 2,866 | |||||

reported in cost of revenues | 323 |

| 418 | 2,809 |

| 1,365 | |||

reported in sales, general and administrative expenses | 1,134 |

| 294 | 4,017 |

| 1,501 | |||

Amortization of purchased intangible assets | 313 | 140 | 1,024 | 779 | |||||

M&A costs | 126 | 35 | 500 | 527 | |||||

One-time charges | - | - | 584 | - | |||||

Goodwill write-off | - | - | - | 1,697 | |||||

(b) | |||||||||

Adjustment to GAAP Net Income: | 2,031 | 1,387 | 11,018 | 9,507 | |||||

Stock-based compensation, of which: | 1,457 | 712 | 6,826 | 2,866 | |||||

reported in cost of revenues | 323 |

| 418 | 2,809 |

| 1,365 | |||

reported in sales, general and administrative expenses | 1,134 |

| 294 | 4,017 |

| 1,501 | |||

Amortization of purchased intangible assets | 313 | 140 | 1,024 | 779 | |||||

M&A costs | 126 | 35 | 500 | 527 | |||||

One-time charges | - | - | 584 | - | |||||

Goodwill write-off | - | - | - | 1,697 | |||||

Foreign exchange (gains) and losses | 135 | 500 | 2,084 | 3,638 | |||||

(c) | ||||||||||

Non-GAAP diluted earnings per share presents non-GAAP net income divided by Non-GAAP weighted average diluted common shares outstanding. Non-GAAP weighted average diluted common shares outstanding assumes (i) the 2.9 million shares EPAM sold in its February 2012 initial public offering were outstanding as of January 1, 2010, and (ii) the conversion of the outstanding preferred stock into common stock on an as-converted basis. The following table presents the non-GAAP weighted average diluted common shares outstanding for the periods presented: | ||||||||||

Three Months Ended | Year Ended | ||||||||

December 31, | December 31, | ||||||||

2012 | 2011 | 2012 | 2011 | ||||||

Non-GAAP weighted average diluted common shares outstanding | 46,604 | 45,278 | 46,123 | 45,250 | |||||