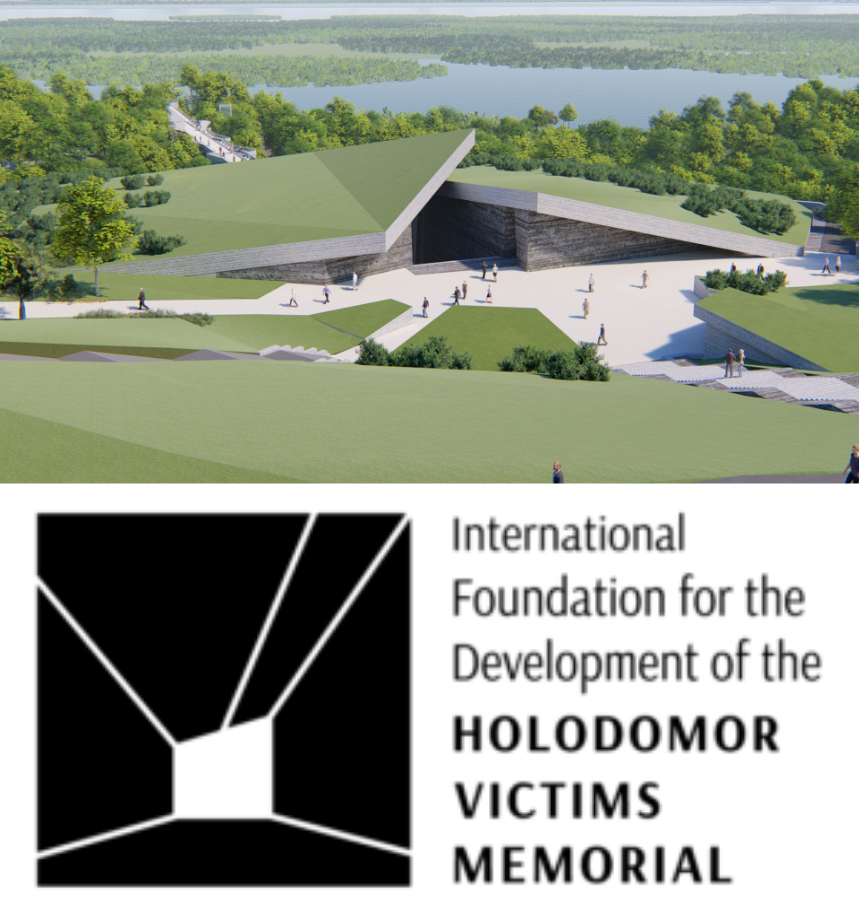

Featured Galleries CLICK HERE to View the Video Presentation of the Opening of the "Holodomor Through the Eyes of Ukrainian Artists" Exhibition in Wash, D.C. Nov-Dec 2021

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

"HOLODOMOR 1932-33: THROUGH THE EYES OF UKRAINIAN ARTISTS" - COLLECTION OF POSTERS AND PAINTINGS

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

USUBC COLLECTION OF HISTORIC PHOTOGRAPHS ABOUT LIFE AND CAREER OF IGOR SIKORSKY PHOTOGRAPHS - INVENTOR OF THE HELICOPTER

Ten USUBC Historic Full Page Ads in the Kyiv Post

Ten USUBC Historic Full Page Ads in the Kyiv Post

Weak global outlook forcing rapid-growth markets to trade with each other

Ernst & Young LLC,

Ernst & Young LLC,

Kyiv, Ukraine, 14 May, 2013

- Mixed fortunes for the RGMs despite overall growth

- Government intervention leading to exchange rate swings could impact RGM competitiveness

- Ukraine: absence of gas deal limits growth this year, but exports set to drive pickup from 2014

LONDON, KYIV, 14 MAY 2013 – Loose monetary policy and quantitative easing intended to stimulate growth in developed markets, has prompted exchange rate swings that in turn could affect export competitiveness in rapid-growth markets (RGMs) according to Ernst & Young’s quarterly Rapid-Growth Markets Forecast (RGMF).

Shifting valuations could have an impact on trade which is becoming increasingly important to the prosperity of nations. However, the early months of 2013 have seen RGMs start to recover after last year’s downturn with growth expected to accelerate from 4.7% in 2012 to 6% in 2014 reflecting a more stable backdrop.

Yet the fortunes for RGMs even within the same region are mixed. Latin America, Mexico and Chile are carrying strong momentum into the middle of the year, while Brazil’s recovery is fragile. Meanwhile, weak demand from the Eurozone still hampers emerging Europe. As trade picks up Turkey is benefiting from its strategic geographical position and economic integration is supporting activity in Africa. Middle Eastern emergers are expanding trade with other RGMs. In Asia while recovery in Korea has been patchy, Chinese growth is set to accelerate from 8.2% this year to 8.5% in 2014.

Alexis Karklins-Marchay, Ernst & Young’s Co-Leader of the Emerging Markets Center comments: “There is relief all around as the global economic outlook appears to have improved compared to this time last year. And as the world emerges from the financial crisis, it is more globalized than ever. International trade will drive world growth over the coming decade, and RGMs are set to play an ever more influential role.”

Carl Astorri, Ernst & Young’s Senior Economic Adviser to Rapid Growth Markets Forecast explains: “Although the RGMs have come through the worst of the crisis relatively unscathed concerns still remain. Accommodative policies introduced to accelerate growth in developed markets and to sustain it in rapid-growth markets may now need to be reigned in to prevent the RGMs competitiveness being damaged.”

Among the BRIC economies, Russia’s exchange rate has moved roughly in line with the Euro, while China’s and India’s have responded to domestic factors (including intervention) rather than just appreciating in value as the Yen and Dollar fell. Brazil, however, has been suffering from an uncompetitive currency for some years and has seen another bout of appreciation, prompting renewed accusations of currency wars. Even with interest rates at a record low in Brazil, rates are still higher than in the majority of RGMs, attracting international investors seeking higher returns.

Asian RGMs are likely to be affected more by the recent weakness in the Yen, particularly if they have close trading links with Japan or if they compete with Japanese companies in export markets. The Yen’s weakness has damaged competitiveness in several countries, particularly in South Korea and China.

Intra-RGM trade spurring growth

Despite current concerns around competitiveness RGMs across the globe have learned to trade their way to growth. Sluggish developed-world growth, and the growing weight of RGMs in the global economy, is spurring them to trade with each other. Today, exports from RGMs exceed 10% of world GDP – more than twice their share a decade ago. In another 20 years, their share will approach 20% – double that of advanced economies.

The advanced economies will also look increasingly to RGMs for growth. Eurozone exports to RGMs were worth US$895b in 2011, up from US$230b in 2000. And in 20 years time, they will have overtaken intra-Eurozone trade.

The machinery and transport equipment sector (which includes consumer electronics and durable goods, as well as industrial goods) will make the largest sector contribution to trade over the next 10 years. Information and communications technology (ICT) equipment will account for most of the growth. This reflects both the anticipated in demand for consumption and investment goods from the RGMs, and the potential to fragment supply chain.

It is not only trade in goods that will grow rapidly over the next 10 years. By 2020 Europe will be exporting more services to emerging Asia than to North America. And exports of services from the US to Latin America will also expand quickly, reflecting strong growth and increasing economic diversification in Latin America.

Alexis comments: “Banking, insurance and other financial services sectors in RGMs will grow as the economies mature and the middle classes expand, offering new opportunities for trade. Demand for more sophisticated financial services is already growing rapidly as wealth levels rise.”

Lower trade barriers to boost growth

Lower trade barriers will boost exports and, ultimately, growth particularly in Southeast Asia. The proliferation of regional trade agreements will enable the free movement of capital, services and people.

Alexis comments: “Many governments in RGMs are negotiating away decades of trade barriers and market distortions in pursuit of larger markets, lower prices and entrepreneurial opportunity. At the same time, they are putting in place the infrastructure to help goods cross borders and reach, or arrive from, far-flung continents. It is the rising importance of RGM economies and their increasing commitment to trade, which will shape profound changes in patterns of world production and demand.”

Meanwhile, Indonesia, Malaysia, Thailand and Vietnam continue to benefit from a mixture of resilient domestic demand and rising across Southeast Asia.

UKRAINE: Absence of gas deal limits growth this year, but exports set to drive pickup from 2014

The recession caused by industrial decline has continued into the first quarter of this year, and recovery will only begin when EU markets regain strength. As a result, we now see GDP growth of just 1% this year (down from 2.4% in the previous edition) and little changed from 2012. The large current account deficit and a need to roll over foreign debt will require new external loans and more FDI inflows. But in the absence of a gas deal with Russia (agreement proved elusive at talks in early March), a new IMF loan may require energy price rises that further delay the economic recovery.

The virtual elimination of inflation has avoided a further cost shock from currency depreciation. But delayed price rises (requiring subsidies that have widened the budget deficit to about 5% of GDP) have stored up pressures that will lift inflation to around 7% by the end of 2013.

Alexei Kredisov, Managing Partner for Ernst & Young in Ukraine, Co-Leader of the Emerging Markets Center at Ernst & Young Global: "According to the study, growth is forecast to pick up to around 4% in 2014-16 as EU markets recover. And the outturn could be better if improved dialogue allows an EU free trade deal to proceed or Russia agrees to cut gas prices on terms that do not damage EU relations. But this is balanced by downside risks of currency depreciation and temporary capital controls if an IMF standby or alternative bilateral loans cannot be secured in time”.

Moving away from the dependence on commodities in Latin America

Resource-rich countries in Latin America escaped relatively unscathed from the 2008-09 global financial crisis. This was partly thanks to rising commodity prices. However, commodity prices are subject to large cyclical swings over time, and can fall as well as rise. The report indicates that there will be a shift away from the reliance on commodities that characterized export growth from 2000-10, toward more manufactured products.

However, currently growth in Chile is underpinned by stable macroeconomic conditions and the stronger world demand for copper, its main export. Growth is expected to be 5% this year and next.

Mexico is benefitting from its lower trade barriers and last year its export sector was one of the strongest performers among the RGMs. RGMF expects that transport equipment and vehicle exports will expand rapidly as demand rises in the RGMs. Although Mexican growth slowed toward the end of last year, the report predicts that momentum to build throughout 2014.

Short-term growth prospects in Brazil are constrained by structural bottlenecks and lingering competitiveness challenges despite record low interest rates and efforts to boost the economy with tax cuts and credit incentives. Therefore RGMF has cut its forecast for growth for Brazil from 3.9% to 3.1% for this year.

Asian commodity demand benefiting Africa but growth prospects in European RGMs remains low

Asian commodity demand is benefiting Africa, especially oil producers Nigeria and Ghana. However, domestic activity in South Africa has weakened.

The Middle East continues to gather momentum as a commodity exporter, manufacturer and market, with growth more than doubling between 2012 and 2014. Eastern European RGMs are still hindered by the weakness in their Eurozone neighbours. Contraction is likely this year in the Czech Republic. Poland will grow but slowly and the Russian economy will remain softer.

Looking ahead

Alexis concludes: “The RGMs have had a good start to the year and this is expected to continue as downside risks to growth recede. RGM countries must now focus on making the most of the new trading opportunities that arise and will be best placed to secure strong and sustainable growth for the future.”