Featured Galleries USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

Holodomor Posters

Holodomor Posters

CMS “Restructuring Wednesdays”

June 17, 2020 – "Debt restructuring

June 17, 2020 – "Debt restructuring

Doing it right" at 14:00 UA Time

.jpg) With all the quarantine measures being put in place as a result of the outbreak of COVID-19, many businesses are experiencing interruptions in their activities which would inevitably, if not yet, have a serious impact on their performance. The world economy is entering global recession for the first time in over 70 years and Ukraine’s economy is likely to be affected significantly by these events. Revenues for many businesses have dwindled substantially or disappeared completely.

With all the quarantine measures being put in place as a result of the outbreak of COVID-19, many businesses are experiencing interruptions in their activities which would inevitably, if not yet, have a serious impact on their performance. The world economy is entering global recession for the first time in over 70 years and Ukraine’s economy is likely to be affected significantly by these events. Revenues for many businesses have dwindled substantially or disappeared completely.

We invite you to join us for a CMS “Restructuring Wednesdays” webinar in which our law  experts will touch on the impact of these events on financial viability of your business and practical steps that businesses can take to reduce disruption and to continue to operate even in the circumstances of financial stress and difficulties.

experts will touch on the impact of these events on financial viability of your business and practical steps that businesses can take to reduce disruption and to continue to operate even in the circumstances of financial stress and difficulties.

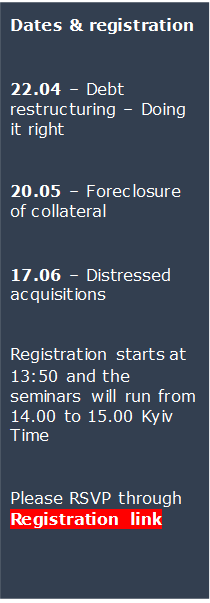

We start on Wednesday, 22 April with webinar “Debt restructuring – Doing it right” at 14:00 Kyiv time via Zoom platform. CMS team suppose that there are some key issues that businesses here in Ukraine should be aware of.

You will receive answers to major questions:

Can Ukrainian businesses overcome financial difficulties resulting from the business downturn: could restructuring may become a viable option?

Which restructuring procedures are available and how to choose the most suitable one?

How to deal with the constrains of restructuring and influence creditors?

Which restructuring tool to use and what to consider for getting desirable result?

Risks specific to Ukraine – could these be new post-pandemic opportunities?

Then we will continue with:

Wednesday 20 May - Foreclosure of collateral. This session will explore the different ways of conducting a foreclosure and enforcement process for the various asset classes, in particular, real estate. We will analyse the benefits and disadvantages of the available options.

And

Wednesday 17 June - Distressed acquisitions.

Purchasing distressed assets and companies carries certain challenges and requires an understanding of a wide range of issues beyond financial restructuring, such as employment, anti-trust or regulatory matters. This session considers the structuring of distressed sales, issues relevant to both sellers and purchasers, including on the acquisition of assets in and through bankruptcy.

More Restructuring Wednesdays to come by the end of 2020…

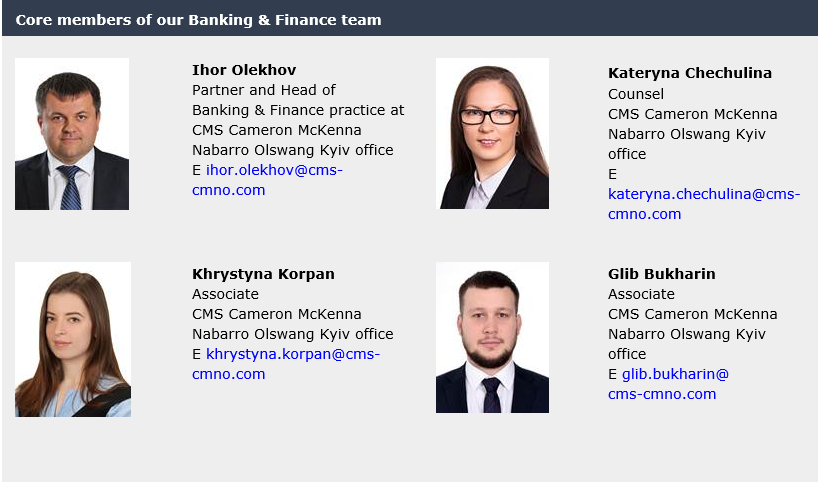

CMS Restructuring Wednesdays will be delivered by the core members of our Banking & Finance team. They will be supported by matter experts from other practice groups – including corporate, employment, litigation and competition – for the relevant sessions.