Featured Galleries USUBC COLLECTION OF OVER 160 UKRAINE HISTORIC NEWS PHOTOGRAPHS 1918-1997

Holodomor Posters

Holodomor Posters

RENT FOR BUSINESSES CAN BE REDUCED DURING QUARANTINE

Asters, Kyiv, Ukraine,

Asters, Kyiv, Ukraine,

Apr 16, Thu, 2020

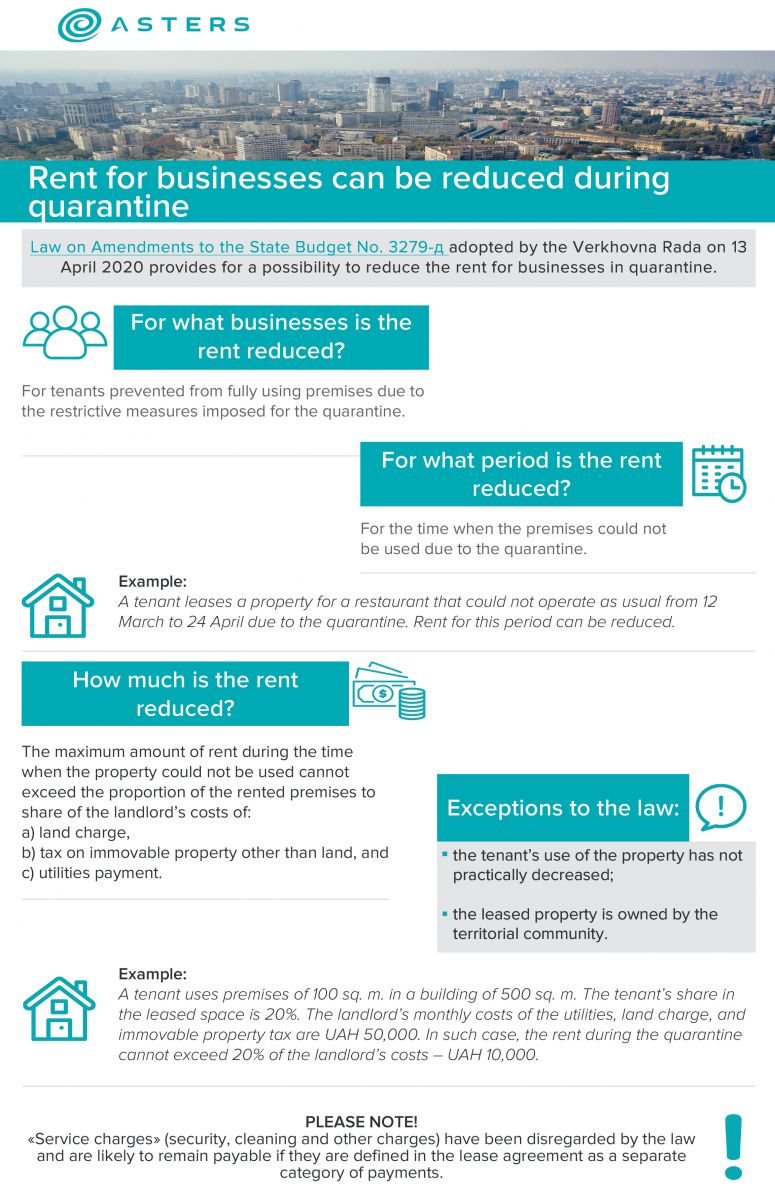

Law on Amendments to the State Budget No. 3279-д adopted by the Verkhovna Rada on 13 April 2020 provides for a possibility to reduce the rent for businesses in quarantine.

Law on Amendments to the State Budget No. 3279-д adopted by the Verkhovna Rada on 13 April 2020 provides for a possibility to reduce the rent for businesses in quarantine.

For what businesses is the rent reduced?

For tenants prevented from fully using premises due to the restrictive measures imposed for the quarantine.

For what period is the rent reduced?

For the time when the premises could not be used due to the quarantine.

Example:

A tenant leases a property for a restaurant that could not operate as usual from 12 March to 24 April due to the quarantine. Rent for this period can be reduced.

Exceptions to the law:

- the tenant's use of the property has not practically decreased;

- the leased property is owned by the territorial community.

How much is the rent reduced?

The maximum amount of rent during the time when the property could not be used cannot exceed the proportion of the rented premises to share of the landlord's costs of:

a) land charge,

b) tax on immovable property other than land, and

c) utilities payment.

Example:

A tenant uses premises of 100 sq. m. in a building of 500 sq. m. The tenant's share in the leased space is 20%. The landlord's monthly costs of the utilities, land charge, and immovable property tax are UAH 50,000. In such case, the rent during the quarantine cannot exceed 20% of the landlord's costs – UAH 10,000.

Please note!

"Service charges" (security, cleaning and other charges) have been disregarded by the law and are likely to remain payable if they are defined in the lease agreement as a separate category of payments.

To note, there may be further technical and substantive amendments to the text of the Law, as no final wording of the Law is available at the time of writing of this alert.

To get more information or discuss business and legal implications for your company caused by novel coronavirus outbreak please get in touch with Asters COVID-19 task force at covid19-response@asterslaw.com